Get the free c 159d

Show details

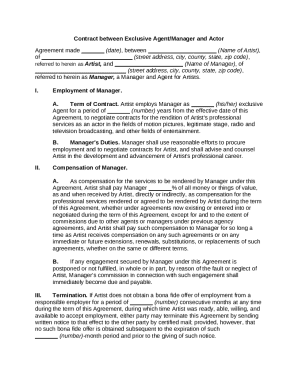

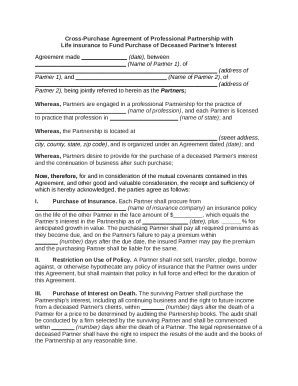

Provide the date of each signature. This form C-159D is to be filed in duplicate with the other documents of the dissolution package. NJ Division of Revenue PO Box 308 Trenton NJ 08646 Rev 9/05 OVERVIEW OF DISSOLUTION REQUEST PROCESS USING FORM C-159D A corporation may be dissolved by the written consent of all its shareholders entitled to vote on the action. To effect such a dissolution all shareholders shall sign and file in the Office of the T...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign certificate of dissolution form

Edit your c 159d form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c 159d form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing c 159d form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit c 159d form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out c 159d form

How to fill out 159d?

01

Gather all necessary documents and information such as personal identification, financial records, and relevant forms.

02

Carefully read and understand the instructions provided on the form 159d.

03

Begin by filling out the basic information section, including your name, address, and contact details.

04

Follow the prompts to provide the required details regarding your financial situation, income, and assets.

05

Make sure to accurately report any deductions or exemptions that apply to your case.

06

Double-check all the information provided, ensuring its accuracy and completeness.

07

Sign and date the form as required.

08

Make a copy of the filled-out form for your records before submitting it.

Who needs 159d?

01

Individuals who are required to report their financial information for various purposes.

02

Any individual who is requesting a specific service or benefit that requires the completion of form 159d.

03

Individuals going through legal proceedings and need to disclose their financial status.

Note: The specific requirements and purposes for the form 159d may vary depending on the jurisdiction and the specific context in which it is being used. Therefore, it is crucial to refer to the instructions and guidelines provided with the form to ensure accurate and complete filling.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 159 for SBA?

Purpose of this form: The purpose of this form is to identify Agents and the fees and/or compensation paid to Agents by or on behalf of a small business applicant (“Applicant”) for the purpose of obtaining or expediting an application for a loan guaranteed by the U.S. Small Business Administration (SBA).

What is a SBA 912 form for?

SBA is collecting the information on this form to make a character and credit eligibility decision to fund or deny you a loan or other form of assistance. The information is required in order for SBA to have sufficient information to determine whether to provide you with the requested assistance.

What is a 159 form?

The FCC Form 159 "Remittance Advice" and FCC Form 159-C “Continuation Sheet” is a multi-purpose form that must accompany payments to the Federal Communications Commission and is also provided after payment has been made to serve as a portion of the receipt.

How to fill out SBA 1919?

How to Fill out SBA Form 1919 Step 1: Fill in the identifying business information in Section I. Step 2: Complete questions 1 through 11 in Section I. Step 3: Complete questions 12 through 16 in Section I. Step 4: Review Section I and sign and date at the bottom of page 3 of the form.

What is the SBA form 1920?

The purpose of this form is to collect identifying information about the Lender, information about the loan guaranty request, sources and uses of funds, the proposed structure (which includes pricing and the loan term), the Small Business Applicant, and compliance with SBA Loan Program Requirements.

What is a SBA Form 1919?

Purpose of this form: The purpose of this form is to collect information about the Small Business Applicant (“Applicant”) and its principals, the loan request, indebtedness, information about current or previous government financing, and certain other topics.

What is a 1919 tax form?

The SBA form 1919 is a borrower information form that is required for all SBA loan applicants. The form must be completed by all partners with at least 20% equity in the company, plus each officer and director.

What is sba 1920?

SBA Form 1920, Lender's Application for Loan Guaranty 5. removed questions relating to business valuations and construction that were not pertinent to determining eligibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send c 159d form to be eSigned by others?

When your c 159d form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the c 159d form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your c 159d form.

Can I edit c 159d form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share c 159d form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is form c 159d?

Form C 159D is a tax form used for reporting specific financial information to the relevant tax authority.

Who is required to file form c 159d?

Entities and individuals who meet specific financial thresholds or requirements as defined by the tax authority are required to file Form C 159D.

How to fill out form c 159d?

To fill out Form C 159D, follow the instructions provided with the form, which typically include entering personal or business information, financial data, and ensuring that all required fields are completed accurately.

What is the purpose of form c 159d?

The purpose of Form C 159D is to collect necessary financial information that assists the tax authority in ensuring compliance with tax laws and regulations.

What information must be reported on form c 159d?

The information that must be reported on Form C 159D typically includes income, deductions, and other financial details as specified by the tax authority, along with any identification information about the filer.

Fill out your c 159d form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

C 159d Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.